Insights / News and Opinion / Unlocking the potential of kids content on SVOD

News and Opinion / 9th June 2022

Peppa Pig, Paw Patrol, Pokémon. The best of SVOD’s kids entertainment contains more Ps than a supermarket frozen food aisle. Not only are these brands among the most lucrative for merchandising, they’ve also sustained consistent viewing levels on streaming platforms for the past few years.

A coincidence?

Or are they among the smartest entertainment companies to unlock the potential of kids content on SVOD.

When talking about streamed content, we tend to focus on high profile titles. Runaway hits like Squid Game, Stranger Things and Money Heist are great for subscriber acquisition and brand awareness, but they’re not enough to keep subscribers’ usage high day-in day-out.

Previous research shows that sit-coms and anime are cornerstones of SVOD catalogues in regards to subscriber retention. High-episode counts and rewatchability keep viewers engaged for the long haul. Whereas hit limited series have a much shorter life-cycle, keeping viewers engaged for a month or two (if you’re lucky).

Could it be that kids content plays a similar role to sitcoms and anime when it comes to subscriber retention? Thanks to SoDA’s latest upgrade, Digital i can reveal enhanced behavioural insight related to kids content and viewing on Prime Video and Netflix.

In 2013, Netflix launched a feature that would later be adopted by all major streamers, the kids profile. This feature enables the account holder to set up a profile that can only access content suitable for children. This upgrade, along with an improved kids content slate, arguably made Netflix the go-to destination for parents in need of a break.

One of our latest developments enables SoDA subscribers to analyse the usage of kids profiles. This reveals a new layer of insight into the behaviour of streaming’s youngest fans.

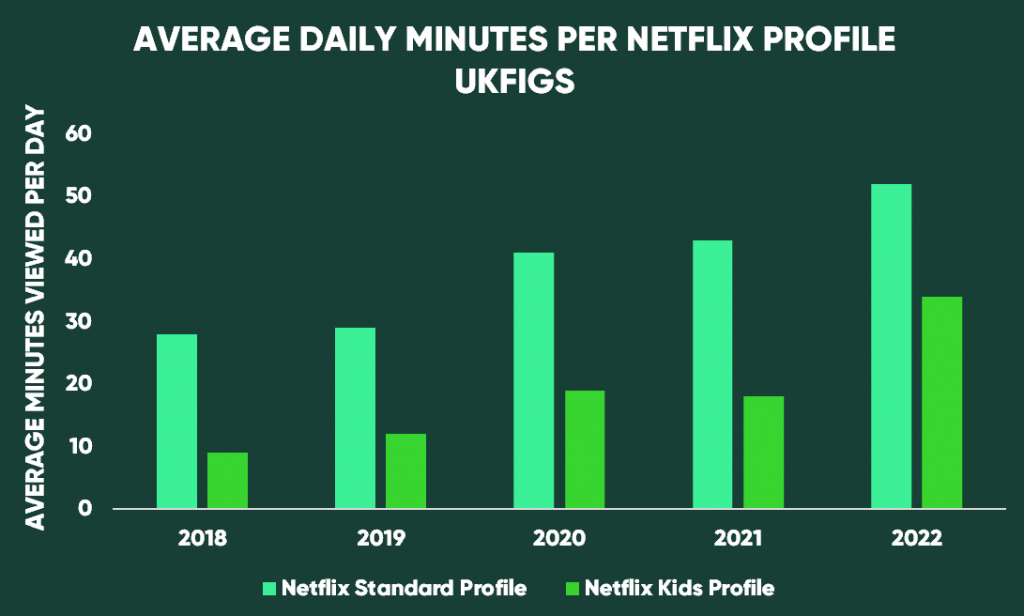

Kids profiles streamed 3.6 times more content on Netflix in 2022 than in 2018. This is double the increase seen for standard Netflix profile usage across Europe.

In 2018, the average Netflix kids profile was watching just under 10 minutes of content per day. This has steadily increased over the years and taken a leap from 2021 to 2022. Now, the average European Netflix kids profile streams 34 minutes of content per day.

Prime Video has yet to see this large uptick in kids profile usage, having only introduced the feature in 2019.

So, it’s all well and good that Netflix’s improved kids content slate is driving more kids profile usage – but what impact does this have on the overall account?

Could kids viewing have a far-reaching effect on adult behaviour as well?

Let’s find out.

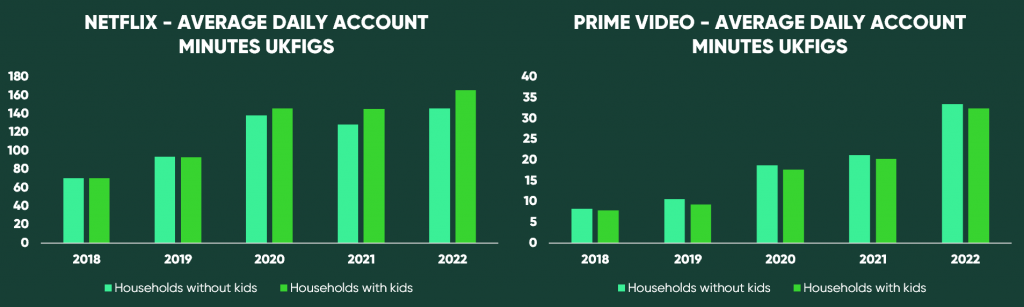

Before 2020, Netflix-subscriber households with kids watched around the same amount of Netflix per day as subscribing households without kids. In 2018, both demographic groups were streaming around 70 minutes of Netflix content per day. This figure rose to around 93 daily minutes in 2019.

In 2020, everything changed. Europe-wide covid-induced lockdown restrictions boosted viewing from 93 minutes per day turned to 139 minutes per day for subscriber households without children. For those with children it rose even higher. In the year the world stopped, households with kids were streaming 146 minutes of Netflix content per day.

While viewing for European subscriber households without kids dropped slightly in 2021, usage of subscriber households with kids remained more or less the same. This is an understandable trend, seeing as the closure of schools had a direct and ample impact on kids viewing.

Enter 2022. Schools are open. Life is approaching a new normality. Netflix viewing? In spite of fears of slowing subscriber rate. Usage is higher than ever.

For the year so far, Netflix viewing for subscriber households with kids has reached a whopping 166 minutes per day. This dwarfs the still impressive rise in usage by households without kids which now averages 146 minutes per day.

High daily usage means low risk of churn. Netflix is fighting it out to keep dominance in the streaming wars.

In contrast, Amazon Prime Video has experienced no such increase. Prime Video viewing is more or less exactly the same, whether a subscriber household has children or not. However, this might be set to change.

There are signs that Prime Video is starting to make a play for the coveted kids viewing. The fourth Hotel Transylvania film broke records for the streaming service. We can expect to see more kids movie releases such as this on Prime Video.

Disney+ also launched during prime pandemic time, generating impressive subscriber numbers of a relatively short period of time. While the Disney+ kids offering is second to none, initial research shows that Disney+ still needs to convince parents to hang around on the service to cement its place for all members of the household.

Kids love films. Hotel Transylvania, Shrek, Encanto, The Mitchells and the Machines. All films that pulled in large family audiences for the world’s biggest streamers. But, even for kids, there is a ‘rewatch’ limit, though it may be in double figures…

As with adult viewer behaviour, success for kids viewing comes in two parts: capture attention with flagship content, for children this would be a blockbuster movie/franchise like those mentioned above. Then, keep the viewers hooked with a long-running, easy-to-watch, digestible series. At the heart of this, is balancing the correct recommendations, great content and a smooth user experience.

No small feat.

Gabby’s Dollhouse and Cocomelon are examples of new series that have successfully engaged younger viewers on Netflix. In the competitive world of kids streaming, great movies alone are not enough to activate the churn-minimising power of young fans.

With the streaming wars in full flow, it’s no doubt that children’s content will prove to be a vital battleground. As well as helping to retain subscribers, having a strong catalogue of children’s programming will be key to help building franchise loyalty in the future

However, with the global spread of Disney+ and the impending roll-out of Paramount+ and HBO Max, Netflix and Prime Video will be competing with global pillars of children’s content.

Do you want to understand more about the role of kids content when it comes to subscriber retention?

Do you want to understand how to maximise the potential of kids content on SVOD?

If so, please get in contact here.

Know your audience.

Join the viewing revolution.

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research